how to put instacart on taxes

Does Shipt take out. The leader in online grocery delivery is also on the verge of.

Instacart Driver Jobs In Canada What You Need To Know To Get Started

Instacart has filed with the Securities and Exchange Commission SEC to go public.

. According to salary review websites Instacart shoppers make approximately 15 per hour. Youll include the taxes on your Form 1040 due on April 15th. This is what the final total is after you add other income to your gross profit.

Lets look at some common expenses youll have as an Instacart delivery driver. Instacart used to offer pay per item and now in some markets they are paying lower rates instead. It may be in the process of ensuring that these mechanisms are in place or it may have decided that its not worthwhile to deliver tobacco products.

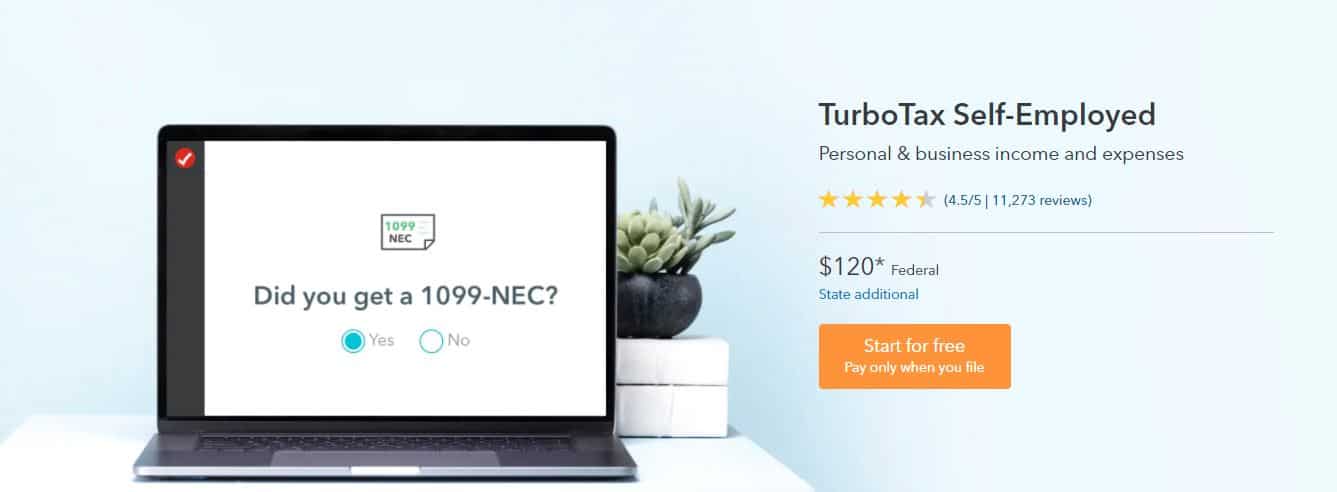

Youll need your 1099 tax form to file your taxes. Bloomberg -- Instacart Inc a 10-year-old grocery delivery startup that was once one of the most highly valued of its gig-economy generation is preparing to. All eligible items including fresh foods will be listed depending on your address.

However shoppers state that you can make 20 or more per hour if you get high-paying batches and are in a busy market. Rates are super low and some as low as 5 for a delivery. For Instacart to deliver cigarettes itll have to put in place a mechanism to ensure that these conditions are being met or it may have to face the wrath of the law.

You dont need the 1099 to file your tax return if you already know how much you made. Yes your 1099 just tells you and the IRS what you made last year. When you file your taxes you have to certify on Part IV.

Information on Your Vehicle that you have evidence to support your deduction and that the evidence is written. Said I had planned on driving for Instacart over the last week but upon entering the app it looks as though Instacart no longer is offering pay per item. If Same-Day Delivery is not available in your area you may be interested in nationwide CostcoGrocery.

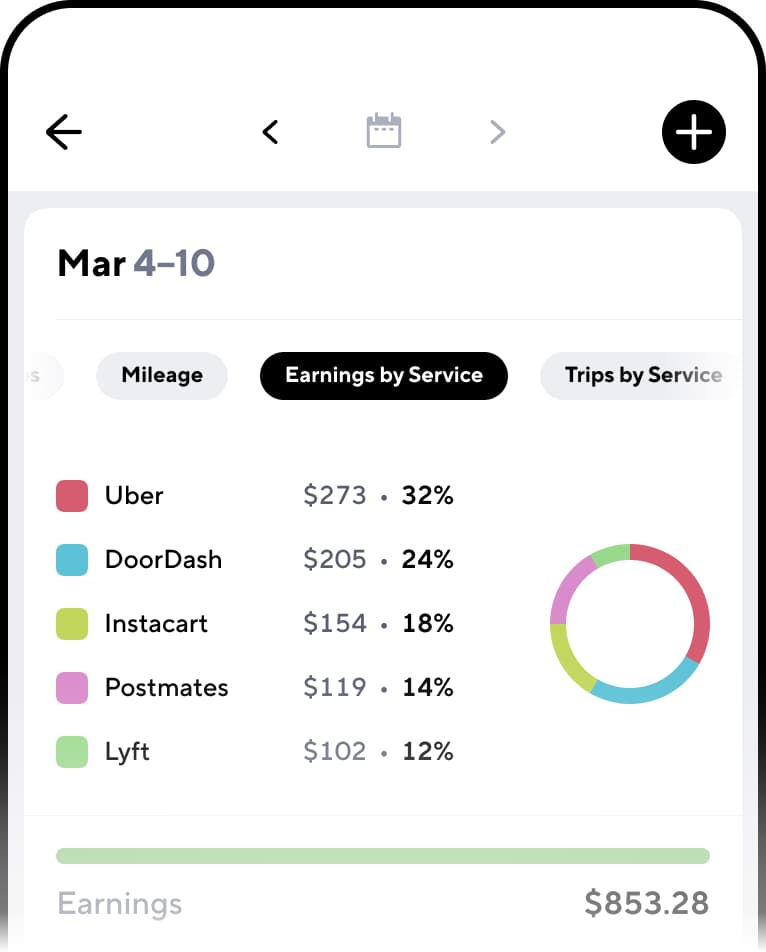

Your profits count as earned income that you can put into a Traditional IRA or Roth IRA. Whether you keep a mileage log or you use an app like Hurdlr or TripLog you need to be able to put that information into a written log that satsifies these four requrements. Companies going public in 2022.

The San Francisco-based grocery delivery chain disclosed today that it had submitted a draft registration. According to other Instacart shoppers on forums like Reddit or on YouTube the average hourly pay is also around this amount. The same-day delivery program via Instacart is a strategic move to help PlantX better serve our growing plant-based community while enhancing the Companys operational efficiency said PlantX.

I expect that for more than 90 of us this number is going to be the same thing as what we put in Line 1. Same-Day Delivery Powered by Instacart is available to members in most metropolitan areas. Here are some other big-name companies with plans to go public in 2022.

Instacart partners with Stripe to file 1099 tax forms that summarize your earnings. Weve put together some FAQs to help you learn more about 1099s and how to use Stripe Express to review your tax information and download your tax forms. Common Instacart Shopper Expenses.

For example if you put money aside for taxes or to save for future car expenses and earned interest on that account that would go here. When are your taxes due. Shipt shoppers typically file personal tax returns by April 15th for the income you earned from January 1st to December 31st the prior year.

Because of this the hourly pay you earn from Instacart will not be the final amount you clear after taxes. If you have a W-2 job or another gig you combine all of your income into a single tax return. If you want to boost your.

IRS deadline to file taxes. View the latest business news about the worlds top companies and explore articles on global markets finance tech and the innovations driving us forward. This means that you have to cover all your own expenses and pay your own taxes.

Can you file your Instacart taxes if you havent received your 1099. Visit Costco Same-Day Delivery and enter your address to see if delivery is available in your area.

Does Instacart Track Mileage The Ultimate Guide For Shoppers

Guide To 1099 Tax Forms For Instacart Shoppers Stripe Help Support

Taxes For Grubhub Doordash Postmates Uber Eats Instacart Contractors

What You Need To Know About Instacart 1099 Taxes

How To File Your Taxes As An Instacart Shopper Contact Free Taxes

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Instacart Driver Jobs In Canada What You Need To Know To Get Started

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Filing Your Taxes As An Instacart Shopper Tax Tips For Independent Contractors Youtube

What You Need To Know About Instacart Taxes Net Pay Advance

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Instacart Q A 2020 Taxes Tips And More Youtube

How To Handle Your Instacart 1099 Taxes Like A Pro

Gridwise Instacart Mileage Tracking For Instacart Shoppers

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

What You Need To Know About Instacart Taxes Net Pay Advance

How To Get Instacart Tax 1099 Forms Youtube

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Delivery Taxes Guide How To File Your Taxes As A Doordash Instacart Uber Eats Courier